BLOG

How to Digitalize Large Amounts of Documents: The Scanning Line

How the digitisation of documents via scan line works and what you should consider when selecting suitable software.

Many companies have the goal of implementing digital business processes that enable them to bid farewell to paper in their office. However, this still seems like a distant reality. According to a recent study, a mere 17% of offices in the UK have gone paperless.

One of the biggest hurdles when it comes to digitalizing documents is the vast number of files that have accumulated over the years. These must be made available electronically before a fully digital process can even begin. In addition, more documents are added each day by post and email, which also need to be processed.

There is often a lack of both time and human resources to digitalize these large quantities of documents. However, simply scanning them is not sufficient. The documents must also find a new virtual home. You will only be able to find your documents at any time if they are correctly indexed, categorized and filed.

The solution to this is a scanning line, also known as digital document capturing. In this blog post, you will learn how this works and what you should consider when choosing a suitable solution. First of all, though, we want to clarify why it’s worth digitalizing documents at all.

Why Is Digitalizating Documents Worthwhile?

Having documents that are available in an electronic format is paramount if you want to digitalize your business processes. There are many advantages to this in comparison to paper. This includes:

Time saving

Imagine if your employees only had to enter a few keywords in a search mask to locate the documents they wanted. They certainly wouldn’t find the desired document in a filing cabinet that quickly. This really does speed up your processes as your employees can work faster and provide information more quickly when customers have questions.

Flexibility

Whether from home, at a customer appointment or during a business trip, you can access digital documents at any time and from anywhere. This flexibility is simply part and parcel of a modern working world.

Security

A digital document has none of the disadvantages that paper has. It does not fade and cannot be destroyed because it is stored on a server. What’s more, every change is documented and versioned in order to ensure the highest level of transparency and traceability. This means that digital files cannot be tampered with.

Environmental awareness

On average, each employee prints up to 50 pages of paper per day, which equates to 1.2 trees per year. If you go without paper to a large extent, this will reduce the carbon footprint of your company. The climate and our environment will be very grateful!

Quality of work

Digital documents cause both the efficiency and general quality of work to improve. Tedious searching and digging through files is no longer necessary while collaboration between departments is simplified as digital documents can be shared more easily. All this ultimately leads to more satisfaction in everyday work.

How Does a Scanning Line Work?

A scanning line is a process used for the digital capturing of paper-based documents. You can implement it once in order to digitalize existing records and then use it again to make newly incoming documents immediately available in a digital format.

Ideally, documents that are available electronically will be automatically extracted and integrated into this capture process. This way, email attachments can also be processed directly and stored correctly.

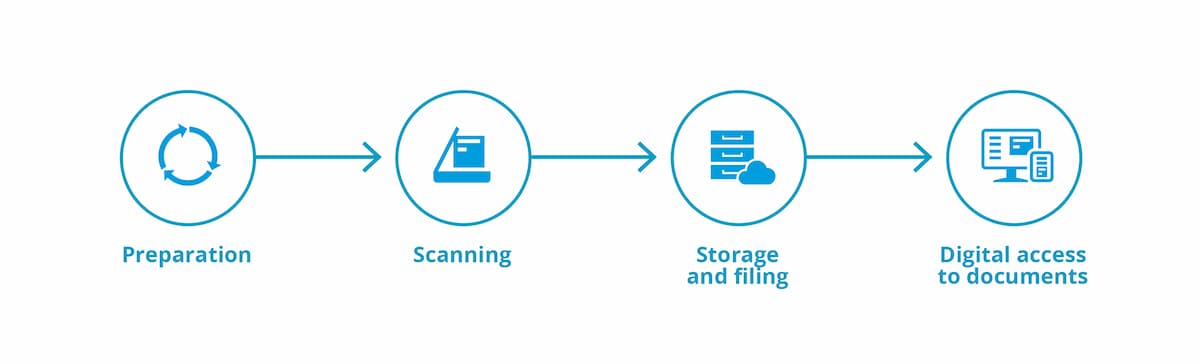

Digital document capturing as part of a scanning line is carried out in four steps:

1. Preparation

The majority of documents to be digitalized in companies are in A4 format. In general, other paper formats can also be scanned, as well as photos and smaller cash receipts. All documents must first be removed from folders, envelopes, files and sheets. Staples and paper clips as well as bindings and sticky notes must also be removed so that all pages can pass through the scanner without any errors.

2. Scanning

The documents are now scanned. The scanner or scan software should be able to automatically capture text and make it searchable. Optical character recognition (OCR) is often used for this. However, extraction technologies supported by artificial intelligence already exist that work in an even more precise manner.

3. Storage and filing

The scanned documents are saved and automatically transferred to the document management system. The system categorizes the scanned information and recognizes whether the document is a delivery note, an incoming invoice or a contract. This way, you can easily use the documents for subsequent digital workflows.

4. Digital access to documents

The digital documents can be retrieved quickly and easily. All you have to do is enter keywords in a search function. Since the documents are stored on a server, they can be accessed from anywhere – even via mobile apps or in offline mode without an internet connection. You also have the option of organizing access by granting different access rights.

Creating a Paperless Office with Digital Documents

A document management system (DMS) is the prerequisite for introducing digital documents and processes in a company.

What Should You Consider When Choosing a Suitable Solution?

The success of your digitalization stands and falls with the right software. This is what you should consider when making your selection:

Ease of use

Your employees should be able to work with the scanner and software after a short onboarding process without any difficulties. An intuitively manageable solution minimizes operating costs and is more quickly accepted by your staff.

Automatic text recognition

You should not go without automatic text recognition using OCR technology or artificial intelligence. This is the prerequisite for making your documents searchable and easy to find. Either the scanner or the downstream software will contain this feature.

Selection of the scanner

Determining which scanner is the right one for your project cannot be answered in a generic sense. This depends on the expected number of documents to be scanned, their size and other requirements. We are happy to help you with the selection process. You can contact our experts here.

A solution for all documents

If you need to purchase separate tools for certain types of documents, this will result in additional costs and extra work. For this reason, make sure that your chosen solution can process almost all documents.

Connection to downstream systems

Your scanning system should transfer documents directly to your ERP system (e.g. SAP) and your document management system, which automatically allocate and store documents correctly. Most solutions are now available as web services, which interact seamlessly with other applications and pass the digital documents on internally.

Conclusion

A scanning line organizes and significantly simplifies the electronic capture of paper documents. Once implemented, you reap the numerous benefits that digital documents bring to the table. After a short time, your employees will not want to operate without them.

With EASY Capture Plus, we offer a holistic solution for your digital document capture. It not only captures the content of paper-based documents; it also captures content from electronic sources such as email attachments. EASY Capture Plus integrates seamlessly into your business processes, transfers the documents to your ERP system and, of course, the EASY document management system. Follow the link to learn more about digital document capture.