BLOG

Electronic invoice formats – standard confusion in Europe?

Digital invoicing using electronic invoicing formats has been an established feature of the B2B environment for several years. Recently, the same has also applied to the area of B2G. After all, the world of public administration also recognizes the advantages of electronic invoices.

To allow the transfer of data to function smoothly, invoice standards are necessary, which means standardized invoice formats – have you heard of Facture X or XRechnung, Fatura PA or ZUGFeRD? These electronic invoice formats could also be of interest to you. Time to shed a little light on things.

The XRechnung invoice format

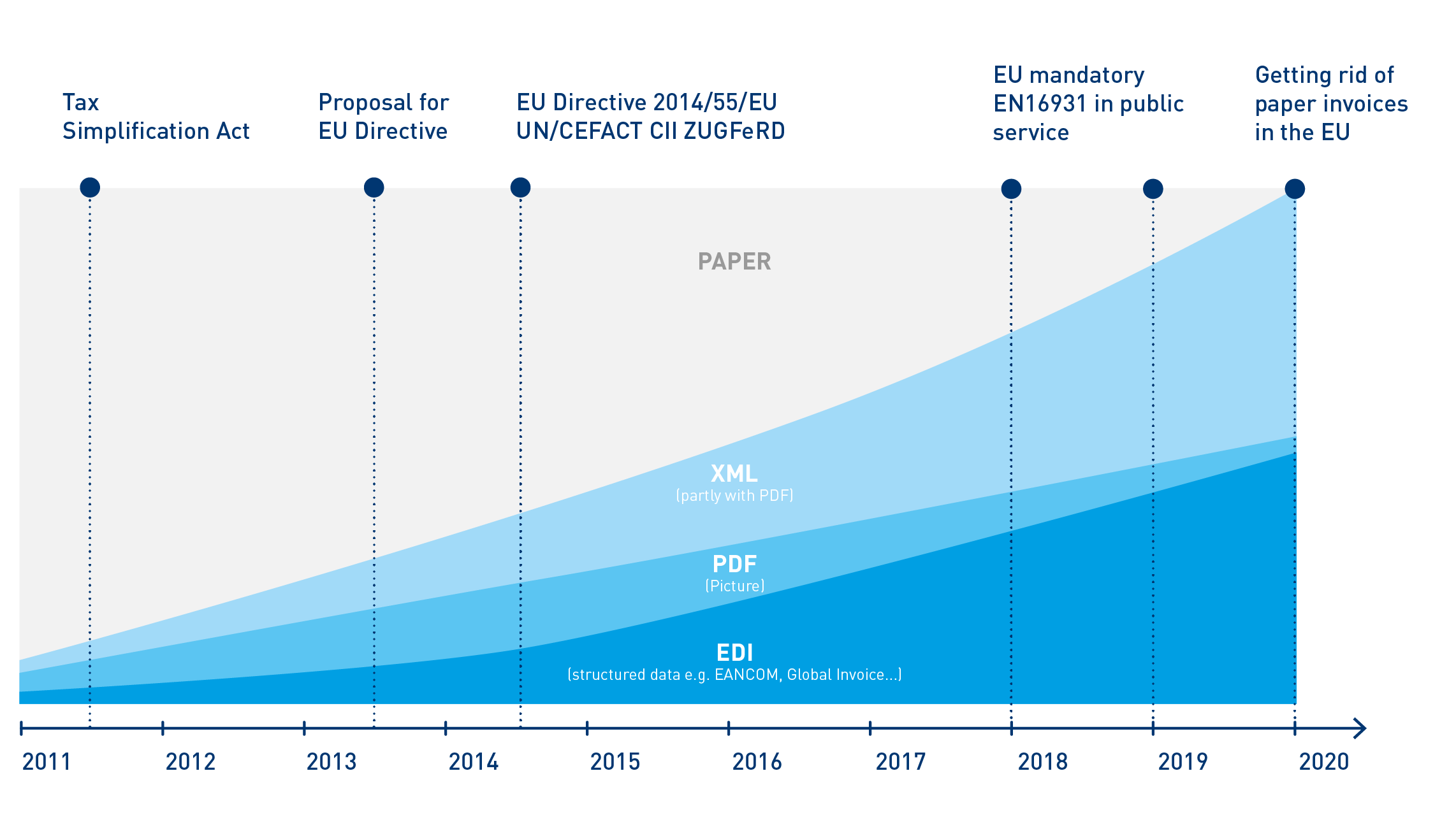

The electronic invoice format was initiated and developed at the 23rd meeting of the IT Planning Council for the German Federal Government and Federal States on October 10, 2017; the title of the meeting was: „Einführung der elektronischen Rechnung in Deutschland“ (The introduction of the electronic invoice in Germany). The reason and the occasion was, and is, EU Directive 2014/55/EU dating from April 16, 2014. In this directive, an agreement was reached at the European level on electronic invoicing for public sector contracts. This demonstrates the political will to advance the use of digital invoicing in the countries of the EU. As is usual with EU directives, the specific implementation into national law is now the responsibility of the EU member states.

The stated objective in Germany is to achieve this with the XRechnung electronic invoice format . Since November 7, 2018 the introduction of the same format for all federal ministries as well as constitutional bodies has been binding, with the federal states and municipalities following approximately one year later. Read more about the topic of the XRechnung invoice format. The leading body for the configuration and development of the electronic invoice format known as XRechnung is the Coordinating Office for IT Standards (KoSIT).

Standards

Fatura PA (IT) , Facture X (FR), XRechnung and ZUGFeRD 2.0 (DE) – are the four names of national invoice formats that differ in details but are based on the European standard EN16931. The latter in turn provides for the XML standards UBL and UN/CEFACT Cross Industry Invoice (CII) for the creation of structured invoices.

What exactly is the XRechnung invoice format?

The XRechnung format stands for an XML-based semantic invoice format. It primarily has the purpose of issuing electronic invoices to public sector clients in Germany.

The XRechnung format is fully documented and product- and manufacturer neutral; it is based on the EU EN 16931 standard. The documentation is available to everyone at no cost. This is one of the key advantages of the XRechnung invoice format. In principle, anyone can read it and implement it.

What does a semantic data model mean in the context of the XRechnung invoice format?

As referred to above, the XRechnung invoice format is XML-based (Extensible Markup Language). XML is included among the machine-readable markup languages. XML results in two important advantages:

- By definition, it is possible for specific pieces of information that belong to an invoice to be specified. The XRechnung invoice standard determines exactly which of these pieces of information are mandatory and which of them are

- The XRechnung invoice format therefore means it is always possible to verify whether the XRechnung document complies with the legal standards. A verification for well-formedness and validity is now possible.

What else can be said about the XRechnung invoice format?

The approach of having created a public standard for electronic invoice formats is commendable. Anyone can read how it works, which means that anyone can implement it. The implementation via XML is also advantageous: not only due to the resulting possibility for checking the legal effect and validity, but also the connectivity in terms of digital signatures with XML signatures. For the time being, however, the latter is still considered a pipe dream. The smaller size of an XML document, and therefore the faster transfer of the invoice data, are also among the advantages of the XRechnung invoice format – at least in comparison with PDF invoice files. It is also clear that the X-invoice format also offers superior parsing options for further processing in accounting systems. The key disadvantage of the XRechnung format is that its area of use is limited to the public sector.

The ZUGFeRD 2.0 invoice format – a hybrid for man and machine

The acronym ZUGFeRD tends to make Germans smile, after all, the word “Zugpferd” means “cart horse” in German. It actually stands for “Zentraler User Guide des Forums elektronische Rechnung Deutschland”, or Central User Guide of the Electronic Invoice Forum, Germany. If the creators of the specification of the ZUGFeRD invoice format are to be credited with sufficient humor and creativity, one of the key characteristics of this electronic invoice format is therefore clear: as a hybrid invoice format, it unites the aspiration to be readable by both machines and people. Put on the right horse, you push the electronic invoicing.

Who created the ZUGFeRD, and when?

The Electronic Invoice Forum Germany (FeRD) developed the specification for the ZUGFeRD invoice format in cooperation with businesses, associations and government ministries. The development got off the ground on June 25, 2014 with the ZUGFeRD 1.0 invoice format. A little while later, Version 2.1.1 of the specification followed. It took place under the aegis of the German Federal Ministry for Economic Affairs and Energy (BMWi).

Objectives of the ZUGFeRD invoice format

Incidentally, the political will to give the topic “electronic invoice formats” the appropriate degree of impetus cannot be overlooked either. The approach was somewhat unconventional, however. After all: One of the key objectives of the ZUGFeRD invoice format is to enable the exchanging of electronic invoices without bilateral coordination. In other words: The exchanging of invoices should work without the sender or recipient of the ZUGFeRD invoice format having reached an agreement in advance.

How does the ZUGFeRD concept and invoice format work?

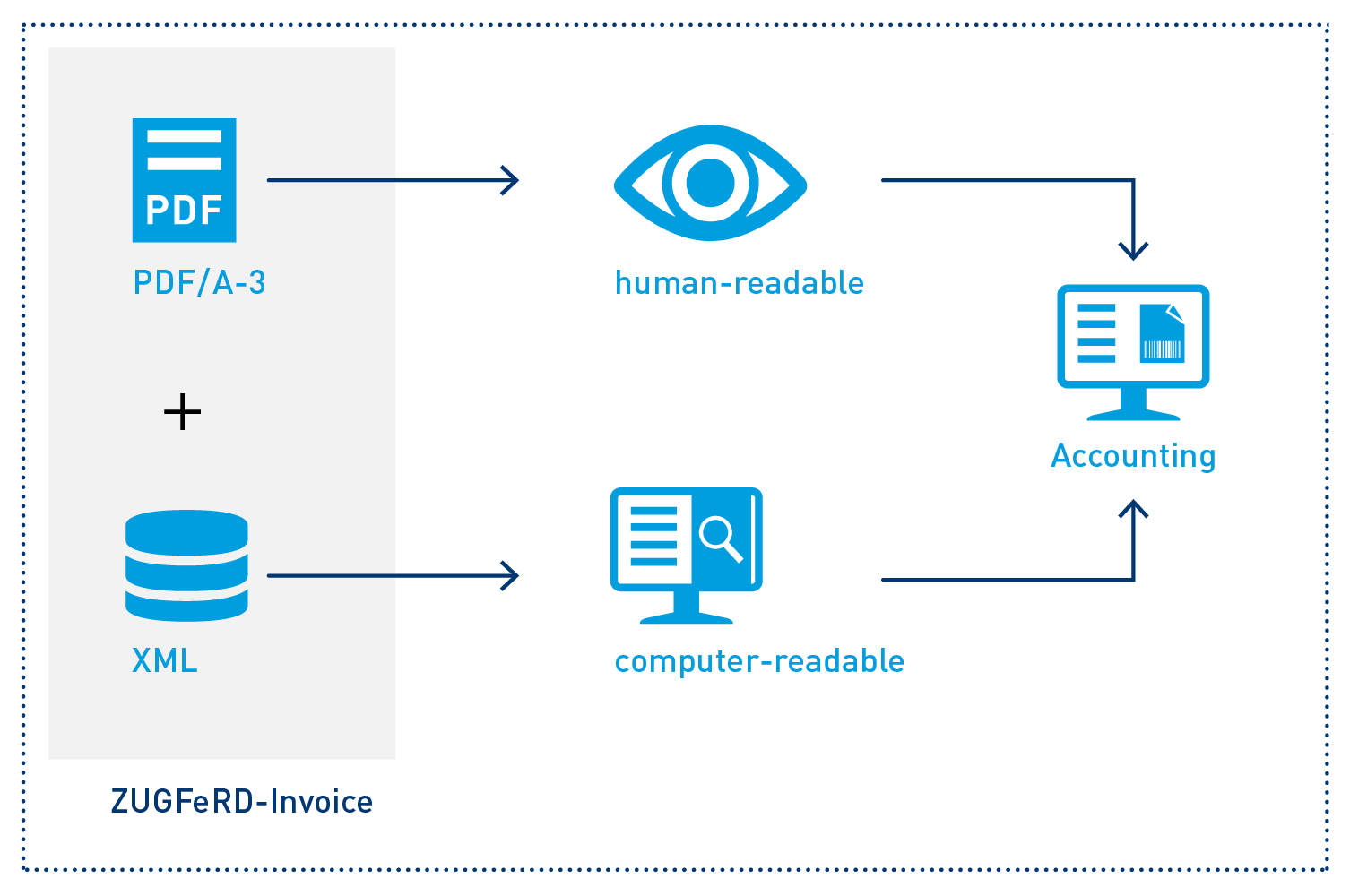

If you take a more detailed look at ZUGFeRD 2.0, you can see that the invoice format consists of two parts: on the one hand, the part which is responsible for the graphic or visual representation of the invoice, and on the other hand, the part that contains the invoice data. This allows for both the human and machine readability to be achieved. In short: The ZUGFeRD 2.0 invoice format presents an invoice to the individual person in the form of a PDF file, while it presents semi-structured invoice data in XML format to the machine. From a technical perspective, the ZUGFeRD 2.0 invoice format implements this with PDF/A-3 as a container format. The PDF container enables random file formats to be embedded. In this way, the ZUGFeRD 2.0 achieves human and machine readability.

Assuming that the presentation of PDF files should no longer pose any problem in the 21st century – after all, PDF readers are a standard feature, regardless of the operating system – it should be possible for anyone to read an invoice in the ZUGFeRD invoice format. This means that the ZUGFeRD 2.0 also fulfills the aspiration of being able to send, receive and read electronic invoices without bilateral coordination. After all: the container format means that both are always sent. It is up to the recipient of the invoice to determine how and what is read or processed.

ZUGFeRD 2.0 and compatibility with the EN 16931 EU standard

Here, the Forum Electronic Invoice Germany (FeRD) has made its decisions wisely. This is because the ZUGFeRD 2.0 invoice format implements the European EN16931 standard for electronic invoicing. Thus, ZUGFeRD 2.0 meets the requirements of the EU Directive 2014/55/EU. These are the same requirements that XRechnung also fulfills. This means that the ZUGFeRD 2.0 invoice format can be used in both national and European contexts. Update: Since 01.07.2020 ZUGFeRD 2.1.1 also supports the requirements of XRechnung in Germany. With the new XRechnung profile, ZUGFeRD 2.1.1 implements the German requirements, national business rules and administration-specific specifications as well as provisions for the XRechnung standard. Meanwhile, almost two years have passed again and the invoice format ZUGFeRD 2.2 has been published. You can find out more about this on the FeRD page corresponding to the update.

The bottom line: electronic invoice formats

To conclude, nothing stands in the way of using digital invoice formats. At present, everything still depends on the area of application. In this respect, the following rule of thumb applies: You can use XRechnung when issuing invoices to public authorities, i.e. in the business-to-government (B2G) sector. The ZUGFeRD 2.0 invoice format is fine for you to use in the business-to-business (B2B) sector, where the use of this format has become established.

Automated accounts payable (AAP) processing

In this whitepaper, we show you ways to further reduce the throughput times of incoming invoices in digital incoming invoice management, while at the same time reducing the required workload to a minimum.