BLOG

Digital invoice approval: faster to booking and payment

Approval processes are crucial for businesses worldwide, ensuring efficiency and accuracy in financial operations. Efficient accounts payable approval processes are vital for businesses globally, enhancing financial management and operational efficiency. As a control mechanism and work step, invoice approval has a fixed place in the invoice verification process.

Every incoming invoice must go through this approval process; this work step is the last before posting and paying the invoice. Electronic invoice software automates these processes, aligning with the global trend towards digital transformation in finance departments. The result: increased efficiency in the invoice process overall, fewer errors in invoice approvals, and improved collaboration regardless of location. All of this leads to cost savings, as digital invoice approval can be 100 percent automated, e.g., as an automated accounts payable processing (AAP). International companies benefit from reduced follow-ups, comprehensive visibility, and increased cash discounts, thanks to digital invoice approvals.

What are approval processes for?

Approval processes are intended to compare the current status of certain content with the target status. The process describes who approves what, when, how and where, and under what conditions. As such, the approval process is a workflow and thus a control and steering instrument for work procedures in companies.

What is digital invoice approval?

Digital invoice approval is the final step before the invoice is posted and ultimately paid. In it, the incoming invoice is reviewed for substantive and technical accuracy to verify:

- whether the prices and quantities shown on the invoice correspond to what was requested in the order.

In the transition to invoice approval, the order is assigned to a cost center, general ledger account, accounting group or company code. This way, the person responsible for material costs is involved in the approval process.

The benefits of electronic invoice approvals

The plus points of invoice approvals can be described in a single sentence:

- They provide a clear overview of all invoice statuses,

- thereby expediting invoicing processes,

- eliminating the need for reminders when payment due dates are exceeded and

- rake in discounts for timely payment.

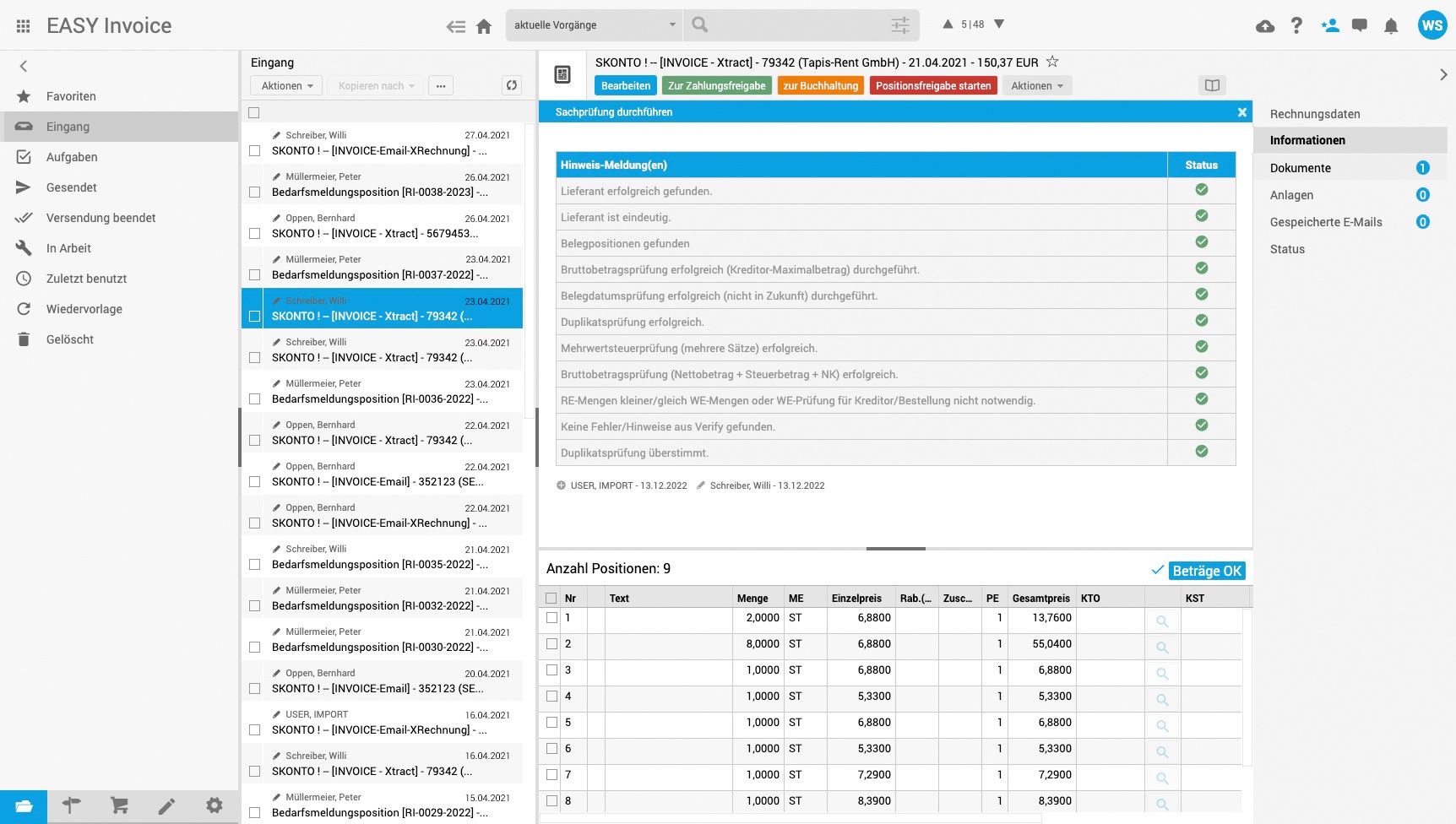

But that’s not all. In fact, there are other benefits of electronic invoice processes. They aim to eliminate the need for running around the office and playing annoying games of E-mail ping-pong. Both were part of the unfortunately necessary evil to clear up discrepancies in invoices before the introduction of digital invoice processing – and both problems avoid digital invoice workflows with approval processes. Ideally, software for incoming invoices is designed so that a single glance at any invoice in the invoice inbox makes it immediately clear what the status of the incoming invoice is and who processed it. So let’s take a detailed look at the benefits of digital invoice processes and approvals.

Advantage 1: Automatically perform compliance checks required by local regulations, such as Tax Acts

The workflow for invoice verification starts automatically as soon as the incoming invoice reaches the company. In the first step, a check is carried out. The system determines whether the invoice includes all the mandatory information. This check automatically detects errors and missing data. No one has to look at the invoice anymore here. If mandatory information is missing, the check notices it immediately and stops the invoice workflow for the incoming invoice at this point. The invoice software points this out to the predefined invoice handler.

Advantage 2: Location-independent checking and approval simply runs better

Employees worldwide collaborate efficiently through digital invoice approvals, ensuring data consistency and compliance with international standards. Does the New York office know what was completed in London?

Digital invoice approvals ensure seamless collaboration across global teams, regardless of location. This was certainly not the case before digital invoice approvals were introduced: having to reach for the phone or type up an E-mail was an unfortunate necessity. Now that we’re living in post-pandemic times, invoice teams and the accounting department should have the tools to handle this so that this question never even comes up. Even though most employees now work remotely in a home office or at different locations, they are still digitally networked together.

This means that the invoice handler in New York always has the same level of information on incoming invoices as the employee in London does. This alone speeds up the processing times of invoices in the company immensely. All employees involved in the invoicing process pull together through invoice approvals.

Advantage 3: Approve invoices faster and reap cash discounts

Many companies issuing invoices offer the prospect of cash discounts for timely payment. This is where digital invoice approvals can rake in profits from cash discounts. This also pays off when it comes to bills in the double digits every day. This way, electronic invoice workflows make the working lives of finance teams not only more pleasant, but also more lucrative. This is certainly the royal class of incoming invoice workflows. Invoice approvals often help prevent the need for reminders.

easy – plays to the full strengths of digital invoice approvals

Of course, the process of registering, processing and approving invoices and receipts is essential for all departments involved in it within the company. This electronic invoicing process ensures maximum clarity in invoicing matters and speedy turnaround times. It is a major benefit to everyone involved in bookkeeping, accounting or controlling – and ultimately to the company as a whole. Suppliers will also be pleased about the fast cash flow. If you think one step further about the invoicing process and the data it generates, you simultaneously create a hub of knowledge with easy invoice and easy archive. After all, the data is already on hand, since you can also archive all invoices and receipts in compliance with the principles of proper accounting, which require you to store them for ten years. This creates the perfect basis for well-founded forecasts and reviews of economic activities.