easy invoice smart description of services / specifications

1. General Information

1.1 easy invoice smart Basic Information

- easy invoice is the efficient solution for digital invoice processing. Incoming invoices are recorded in a secure and transparent process and invoice information is reliably extracted. The invoice then goes through a verification and approval workflow, booking data is transferred to the downstream ERP system and the invoice is archived in an audit-proof manner if required. As the responsible manager, you retain an overview of your invoice processes at all times. easy invoice integrates harmoniously into an existing IT landscape and grows with the company.

- With easy invoice, you can simplify your invoice receipt process. All incoming invoices are first scanned or imported by the system. The data can be read with a high degree of accuracy and checked for accuracy and plausibility by comparing it with existing information from other sources (e.g. ERP systems). On request, additional formal check mechanisms can also be configured. The validated data is then transferred to the checking and approval workflow. Administrators, cost center managers and accountants receive their transactions automatically and can concentrate fully on their tasks in the processing chain. In the next step, the checked and approved invoices can be transferred to the ERP system for posting and then stored in the digital archive in an audit-proof manner if required. Digitized documents are thus available to all authorized users during the checking and approval process as well as at any later point in time. This access can take place both from the solution itself and seamlessly from a connected ERP system.

- easy invoice smart cloud is the standardized “out of the box” solution from easy invoice (see above). It makes it possible to use a best-of-class approach to electronic invoice processing in the easy cloud without having to adapt scripts or workflows. With just a few configuration steps by consultants or expert users, customers receive complete invoice processing in accordance with the cost accounting audit. The degree of standardization of easy invoice smart covers the essential customer requirements for an invoice solution from easy and is the result of years of experience and numerous successful projects in this area. The possibilities for project-specific individualization have been deliberately limited for the benefit of an extremely short implementation phase.

1.2 easy invoice smart cloud

1.2.1 Operations

- Operations of the easy invoice smart cloud solution and the extraction components takes place exclusively on the EASY SOFTWARE AG platform (easy Cloud) and is supported by the EASY SOFTWARE AG Managed Service Team.

1.2.2 Configuration Options

- With easy invoice smart cloud, customization options are only available on the basis of the configuration masks, e.g. release matrix or connection of the e-mail inbox. Further customizations are not provided.

1.2.3 Updates & Upgrades

- The current version of easy invoice smart released by easy Development is always used for easy invoice smart cloud.

1.2.4 Add-ons & Connectors

- When connecting an ERP system (ERP connector), the functionality of the customer-specific connection and transfer parameters (booking records) must be checked with the update / upgrade of easy invoice smart.

- The connection of an ERP system must be evaluated and implemented by a separate consulting project.

2. Product specifications

2.1 Invoice input

2.1.1 E-mail

- Receiving invoices by e-mail is the only intended way to receive invoices.

- Invoices are read and processed exclusively from e-mail mailboxes configured in easy invoice smart.

2.1.2 Paper invoices

- Paper invoices can be captured using various sources, e.g. smartphones, workplace scanners or multifunctional devices (MFPs). This means you can capture paper invoices almost anytime and anywhere and transfer them to the invoice run.

- The digitised, paper invoices are sent by the respective device mentioned above using the device-specific e-mail send function to the mailbox configured for easy invoice smart and processed there.

2.1.3 Invoice File Formats

- The following file formats for incoming invoices are supported by easy invoice smart

- JPG/JPEG

- E-invoice formats (see 2.1.4)

- The invoices are brought into the solution as attachments to emails.

2.1.4 E-invoices (e.g. XRechnung or ZUGFeRD)

- easy invoice smart ermöglicht auch die Verarbeitung strukturierter elektronischer Rechnungen (E-Rechnungen), wie sie beispielsweise im XRechnungs- oder ZUGFeRD-Format vorliegen. Dabei werden die relevanten Rechnungsdaten automatisiert aus den vorgegebenen Feldern der E-Rechnung extrahiert und in den Prüfungs- und Freigabeprozess von easy invoice smart integriert.

- Die Anlieferung der E-Rechnungen erfolgt über denselben Mechanismus wie bei PDF- oder JPEG-Dateien (z. B. per E-Mail an das definierte Postfach).

- Der nachfolgende Prüfungs- und Freigabeworkflow (siehe Abschnitt 2.3) bleibt für E-Rechnungen identisch zu dem für PDF- oder Papierrechnungen. Auch die anschließende Buchung im ERP-System (Abschnitt 2.4) und eine optionale revisionssichere Archivierung (Abschnitt 2.6) erfolgen analog. Somit fügt sich die Verarbeitung von E-Rechnungen nahtlos in den bestehenden Prozess ein und garantiert eine umfassende Nachvollziehbarkeit sowie GoBD-konforme Archivierung.

2.2 Invoice Processing

2.2.1 E-mail

- Invoice processing is started after the invoices have been received in the corresponding easy invoice smart e-mail inbox.

- Invoices received via the easy invoice smart e-mail inbox are displayed in the inbox and can be transferred to extraction – optionally after manual verification.

2.2.2 Extraction / Validation with Master Data

- The invoices – together with the master data – are transmitted to the extraction service.

- The master data must be provided by the customer by means of a corresponding file (e.g. .csv) and is integrated into the solution by the user via the corresponding function in the user interface.

- In case of ambiguous extraction results, the invoices are displayed in the verification client and can be corrected manually if necessary.

- For incoming e-invoices (XRechnung/ZUGFeRD), the metadata is already transmitted in a structured form, which further reduces manual verification and in many cases enables even higher extraction quality.

2.2.3 Extraction / Validation without Master Data

- The invoices are transferred to the extraction and stored in the verification basket after extraction.

- In the internal verification client, the extraction results are compared with the master data and displayed for verification. The quality of the recognition of the contents in the respective fields is also indicated by color codes.

- In this case, neither creditor information is available for selection.

After verification, the document is transferred to the invoice release workflow (see 2.3).

The quality of the extraction with master data transmission is many times higher than the quality of the extraction/validation without master data transmission, as the use of master data means that significantly more basic information is available for intelligent matching of the invoice data.

In the case of an extraction / validation without master data transmission, the results must be corrected manually, or additional contents must be recorded.

Basically, the quality of the document determines the quality of the extraction results. High-contrast, clear writing produces better results when extracting digital documents and scans than light writing on white documents. In addition, the use of so-called “readable PDFs” also increases the extraction quality.

For incoming e-invoices (XRechnung/ZUGFeRD), the metadata is already transmitted in a structured form, which further reduces manual verification and in many cases enables even higher extraction quality.

2.3 Invoice Review and Approval

2.3.1 Approval List

- One approval area can be created for each accounting area. An empty approval area already exists in the basic provision, which applies to all accounting areas that have not been assigned their own drawing area.

- In the approval area, the members are assigned to the respective release levels.

- A signature rule exists for each approval area in which the licensed release levels can be set up.

2.3.2 Release levels (Levels/Tiers)

- In the standard version, 3 release levels incl. factual check are displayed, which can be increased to up to 5 release levels by means of a corresponding license extension. There are additional costs for this license extension.

- Different release limits can be defined at each release level.

2.3.3 Four-eyes principle

- A four-eyes principle for the approval area or a four-eyes principle at certain release stages can be defined.

- The four-eyes principle at the approval area specifies that the four-eyes principle applies at each release level. A second person with the appropriate authorization must then always give approval so that the invoice can be processed further.

- If the four-eyes principle is activated at a release level, the document to be released is presented to two different users of the same release level for release. Here, the dual control principle only applies to the release level at which it was activated.

2.3.4 Routing groups

- Dynamic routing

- Dynamic routing is highly flexible and requires that the respective subsequent routing group is selected manually by the user.

- Defined routing groups

- Routing groups determine the course of an invoice through the different departments.

- If there is more than one route for an invoice, a selection for the next possible department is displayed to the user who is currently approving.

- If only one defined route exists, the invoice is passed on without selection.

- If no route applies, the wildcard routing group is used as a fallback. Members of this routing group (e.g. accounting) can then create or have created additional routes or transfer the invoice of an existing route.

2.3.5 Invoice Receipt

- The approval group receives the invoices to be released in its dedicated group inbox.

- Any member of this approval group can approve invoices from this group inbox.

2.3.6 Cancellation / Return to Subject Check / Return for Revision

- When an invoice is cancelled, the invoice is sent directly back to the previous workflow manager.

- Invoices can be returned to the substantive audit if they are incorrectly allocated.

- In case of an assignment to a non-existing routing group, the invoice is transferred to the accounting department.

2.3.7 Substitution Rules

- Responsibility and representation for the invoices are released through the group mailboxes (release pool). At least two persons must be defined for each release level.

2.4 Posting in the ERP system

2.4.1 Without connection to an ERP System

- easy invoice smart generates a list (booking report) of released invoices for (manual) reconciliation with the ERP system.

- This report is provided as an exportable CSV file and can be used by the customer as an import file for the ERP system used.

2.4.2 Booking in the ERP System with technical Connection of an ERP System (optional)

- The following ERP systems are currently supported.

- Microsoft Dynamics 365 Business Central

- Datev Connect

- The connection of the supported ERP systems must be carried out by a consultant to configure the customer-specific connection and transfer parameters (booking records). (This consulting service is not covered by the “easy invoice smart cloud – Initial Setup Fee”).

2.4.3 Scope of Services for Booking in the ERP System

- The booking records defined by the consultant in 2.4.2 are transferred from the invoices to the ERP system.

The list of supported ERP systems corresponds to the status at the time of creation / revision of this document. Subject to changes and additions.

2.5 User types in easy invoice smart

- The solution distinguishes between different types of users.

- Required users or user types must be ordered separately in easy invoice smart.

2.5.1 Power User

- Typical user roles: Accounts payable clerk, accounting manager

- Trigger: Receipt of invoices

- Activities: Entering invoices in the solution, checking, assigning (cost center, G/L account, auditor), monitoring the invoice process, posting the invoice.

2.5.2 Approval User

- Typical user roles: Cost center managers, functional managers, goods or service recipients

- Trigger: Single invoice for audit

- Activities: Factual examination of the invoice, approval or rejection of the invoice with reasons (e.g. “goods not received”, “goods or service defective”, “quantity discrepancy”, “delivery date not met”, “wrong place of delivery”, …).

2.5.3 Portal User (read only)

- Typical user roles: External auditor, controller

- Trigger: Need for information about posted and archived invoice transactions

- Activities: Search for archived invoices

2.6 Archiving

- easy invoice cloud smart can be extended by the optional archiving with easy invoice smart cloud_Archive Cloud.

- Booking of the archiving option must be done in the same level as the respective main module easy invoice smart cloud. Booking the archiving option follows the same contract terms as easy invoice smart cloud.

- Archiving includes a storage volume in the archive that matches the level. If the defined volume is not sufficient, additional storage volume must be booked.

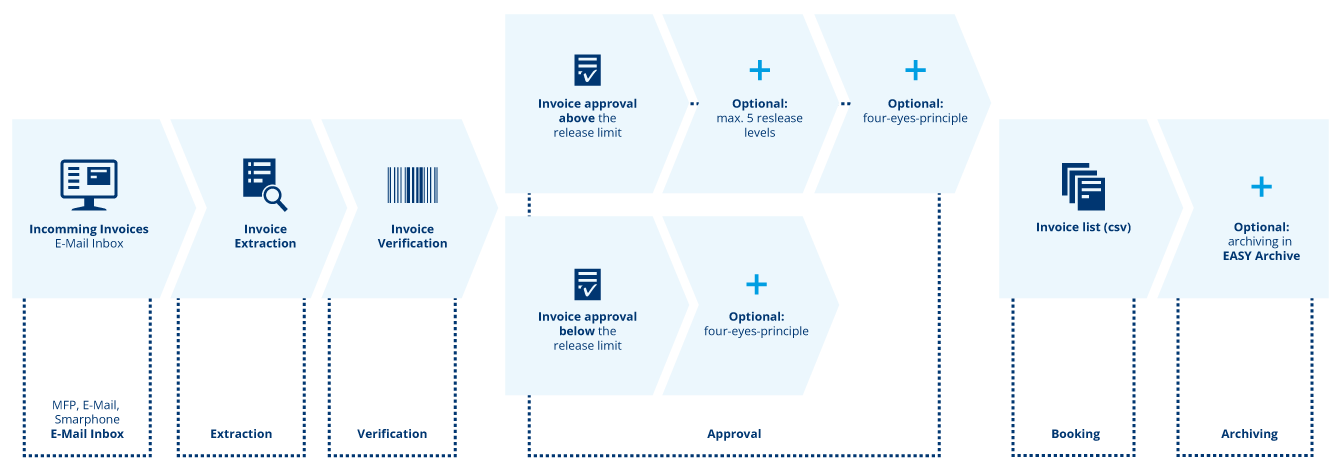

3. Workflow Invoice

3.1 Workflow Description

- Invoice Receipt:

- o The invoice is available in digital form (see also “Invoice File Formats 2.1.3”) in a dedicated e-mail box. Paper-based invoices can be scanned via MFP or smartphone and sent to the dedicated email inbox.

- Invoice Extraction:

- o The invoice is transferred from the dedicated e-mail box to the easy Extraction Service, which reads out the contents of the invoice (see also “Extraction with / without Master Data 2.2.2 and 2.2.3) and, after reading it out, transfers it to the verification client for manual post-processing.

- Invoice Verification:

- o After extraction, the invoice is transferred to a Verify Client. Here, a manual review and post-processing of the invoice information automatically recognized by an Extraction service is carried out.

- Invoice Approval Workflow:

- o After invoice verification is complete, the invoice release workflow starts ineasy invoice smart Web Client. Detailed information on the invoice workflow and the standard scope of functions can be found here: “Invoice Release Workflow 2.3”.

- • Archiving in the easy invoice smart Archive Cloud (GoBD compliant, IDW PS-880 certified) – Optional

- o After the invoice approval workflow has been completed, the invoice can be archived in the revision-proof easy archive Cloud in compliance with the GoBD (archiving incurs an additional charge).

- Posting in the ERP System

- o After the invoice approval workflow has been completed and the invoice has been approved, an invoice list is created for matching the invoices in the ERP system. See 2.4

3.2 Overview Workflow (graphic)

3.3 Description of necessary customized individual Settings

The following settings must be made individually for each customer:The following settings must be made individually for each customer:

- Configuration screen

- Release matrix

- Connection of the e-mail box

- Customized system and communication settings

- Structure of the invoice list

- Connection to ERP System (optional)

- easy archive connection (optional)

4. Invoice Quota Management

4.1 Booked Invoice Volume

- When ordering easy invoice smart cloud, the customer books a certain volume of incoming invoices (each for 12 months).

- The receipt of an e-mail with attachment in the defined invoice inbox counts as an incoming invoice in the sense of the metric. This starts the invoice verification and approval process and reduces the available remaining volume by 1 counter each time.

4.2 Overview of the “used” Invoices

- At the beginning of each month, the customer receives a list of the invoices “consumed” in the previous month.

- The volume of available invoices is reduced with every invoice verification process that is started, i.e. with every invoice received into the solution.

4.3 Exceeding the booked Volume

- When 90% of the booked invoice volume is reached, the customer receives a notification by e-mail on his registered account.

- When 100% of the booked invoice volume is reached, the customer receives a further notification by e-mail to his registered account.

- For each additional invoice processed, the price for Additional Invoice in the corresponding package (according to the offer) will then be calculated and invoiced with the next monthly message.

5. Certifications